Misadventures in Teaching —

Close Enough for Bank Examiners

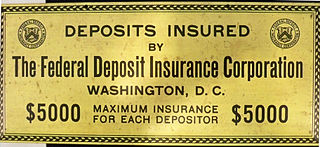

Federal Deposit Insurance Corporation

FDIC is a corporation created by the U.S. Government after over 9,000 bank failures between October, 1929, and March, 1933. Their sign, an early version of which is seen here, indicates that a depositor can feel confident that their money is safe. If an insured bank were to fail, the total deposits up to some limit would be paid by this government-mandated corporation. The maximum per depositor has increased significantly since this sign was printed, it is now $250,000 per account. The idea is that teams of crackerjack bank auditors have investigated the bank to make sure that it is a good risk. You don't have to be an FDIC member to operate a bank, but you won't get much in the way of deposits if you aren't.

I was asked to go to a central FDIC training center in the Washington, D.C. area to teach the Linux/UNIX security course I had written. The students would be traveling in from various regional offices. It was strange from the beginning.

The Unending Conference Call

I took part in a conference call with the training company's

salesman who had sold the event and a representative from

the customer, FDIC.

I asked if the attendees had the needed background,

comfort with the

Linux/UNIX command line

and, critically, the fundamentally important

vi

editor.

This wasn't a class vaguely about security, or a list

of what could be done, it had them working as

system administrators to harden three separate operating

systems: Solaris, Linux, and OpenBSD.

"Oh yes! These people are suuuuper sharp! They use this operating system all the time. In fact, they know so much that a few of them may disrupt the class as they show off how much they know!"

Well, they won't do that very long at all. That would be unfair to those who want to learn. If someone is disruptive, I'll give them one warning. Then I'll kick them out if they persist. Do that to the first one and the others will probably straighten up.

"Oh, no, no, I'm sure they will be well behaved!"

They'd better.

"But these people do know so much that some of them may cause some trouble because they're showing off and may even think they know more about this than you do."

I doubt that. If they do, it would be stupid of them to be in the class. But seriously, if someone is disruptive I'll kick them out.

"Oh, no, no, they will behave! Although some of them may make some trouble because they know so much!"

This went on and on for twenty minutes or more. I should have suspected even more than I did at the time.

Cayman Island Banking Starts Looking Attractive

Once in the classroom for the first day of the course, I found that the conference call had been one long lie (well, other than the parts about where the FDIC training center was located, and how to get in there on a Sunday afternoon to set up the course).

These people had never used any of this family of operating systems. They had never logged in. As far as I could tell, they didn't seem to have ever used any computer operating system, at least not through an interactive command prompt.

The first exercise was a disaster. On the second one I said something like "Well, let's try one more..." It went even worse. During the two exercises I did have them attempt, different pairs of them would call me over to inform me that the exercises did not work.

No, I'm quite certain that they all work. Let's look at your screen.

"No, we're trying, but these exercises do not work!"

Look at your screen. See all those error messages? That's because you aren't accurately typing the commands. Use the solution booklet, it shows you exactly what to type.

"We are using that, because we don't know anything at all about this computer system. But the solutions don't work!"

Yes, they do. See, look here, you aren't typing them accurately. If you accurately type the commands as they're printed in the exercise manual, they work.

"Do you mean to tell me that we have to spell these commands correctly?"

I am not making this up. Multiple groups complained to me that it seemed unreasonable to expect them to accurately type in the commands that they were just approximately copying out of the solution handout. Remember that these were bank examiners. These were people whose job revolves around fussy attention to details. Or so I thought.

After that, I just demonstrated the exercises on the screen. That certainly moved us through the exercises correctly, as I could spell accurately and type far faster than any of them. We were well on schedule for the famous FDIC "Pack-up Friday". This was something the representative had stressed during that conference call.

FDIC pays for five days when they take a four-day class. The announced intent is that they want a final review of the material for most of Friday morning. Then, after a lunch break, they will spend the rest of the day packing their books into boxes that will be shipped back to their home offices.

I was to be paid for five days, so that was just fine with me.

The reality is that about half came in on Friday morning just long enough to sign the daily sign-in sheet and then immediately leave. The rest of them only wanted to start this elaborate packing project right away.

How long does it take to put a binder and a book into a box and then seal the box with tape? If they have to share two rolls of packing tape, about twenty minutes. Then the rest of them bolted. I asked one of the last ones there if this was usual for their training courses, and he assured me that it was.

OK, that gives me plenty of time to pack the gear for the course. And to make a note to myself to never teach for FDIC again.